And try to win a streaming subscription of your choice.

More than the essential,

in 6-month free Packs

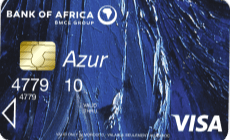

Azur Pack

with an International

Visa

Azur Card

- Withdrawal limit | 4,000 Dhs/Day

- POS and e-commerce payment limit | 6,000 Dhs/Week

- *Individuals aged 40 or over: 9 Dhs per month with 6 months free for all new customers.

GOLD Pack

with an International

Visa

Gold Card

- Withdrawal limit | 10,000 Dhs/day

- POS and e-commerce payment limit | 150,000 Dhs/week

- Withdrawal in Morocco and internationally

- Payment in Morocco and abroad at merchants and on e-commerce sites

- Medical and legal assistance abroad valid when purchasing the travel document with the card

- *Offre valable pour tous les nouveaux clients

Platinum Pack

with an International

Visa

Platinum Card

- Withdrawal limit | 20,000 Dhs/day

- POS and e-commerce payment limit | 350,000 Dhs/week

- Withdrawal in Morocco and abroad

- Payment in Morocco and abroad at merchants and on e-commerce sites

- Medical & legal assistance abroad: valid in case of travel ticket purchase by card and provides Medical services (for the cardholder and their family), arrangement of emergency medical evacuation and repatriation, sending of doctors

- BMCE SECURICARD Insurance: protects the cardholder against fraud and physical assaults near ATMs, as well as loss of documents and car keys

- BMCE Protection Insurance: protects the estate account in case of a claim against deferred debits

- Card Purchase Protection Insurance: Purchase protection insurance that covers against loss, theft, or accidental damage of purchased products up to $5,000 per claim, with a limit of $20,000 per year...

- Platinum Visa Benefits:

- - 6 free visits per year (access to 25 airport lounges in Morocco and internationally)

- - Discounts & perks on a wide selection of hotels: Hotel Club and Visa Luxury Collection

- - Discounts & perks on luxury shopping at the 9 European Outlet Villages

- - Discounts & shopping at airport DUTY FREE stores

- - Discounts & benefits for car rentals (Avis, Hertz & Sixt)

- *Offre valable pour tous les nouveaux clients

Are you a Moroccan living abroad?

Open your account online and enjoy dedicated benefits.

How to Open a Bank Account in 4 Simple Steps

Initiate your request

Complete the opening of your online account with your identification document.

Confirm via video-conference

Confirm your identity live with an advisor, securely.

Sign your contracts securely

Complete your account opening using electronic signature.

Access to your account

Receive your BMCE Direct username by email, password by SMS and download the app.

Perks of having a BANK OF AFRICA Account

More than just a bank, a dedicated partner.

Comprehensive solutions

With BANK OF AFRICA, you benefit from a wide range of products and packages tailored to your lifestyle and ambitions: savings, credit, insurance, and payment methods.

Advisors by Your Side

In each of our branches, our advisors take the time to help you discover the best-fitting options for your needs.

Accessible Bank

Our digital solutions allow you to apply for a loan, save, and manage your daily banking operations from your mobile device, all securely and with advantageous rates.

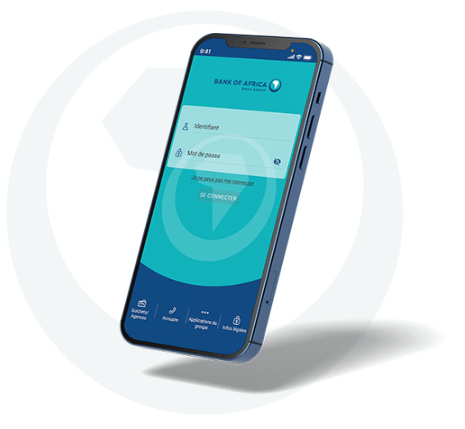

BMCE Direct

With BANK OF AFRICA, Always a solution.

Take control of your accounts with BMCE Direct, the secure app that allows you to view and manage everything in an instant, without having to move. Make transfers, pay your bills, and order your checkbook with preferential rates for more savings.

All in a smooth interface accessible 24/7.

Enjoy a bank that adapts to your daily pace of life.

Enjoy a galaxy of benefits

An open account, a chance to win a streaming subscription

Open your BANK OF AFRICA bank account online and participate in the draw to win a Streaming subscription: Movies, Series, Sports

Your questions, our answers

To open an online account, you must be a natural person residing in Morocco, acting solely for personal purposes (account reserved for individuals).

You will be required to provide:

- Your national identity card (CIN) or residence permit (passport accepted in certain cases),

- Proof of residence if your address differs from the one shown on your identification document,

- A valid phone number or personal email address, necessary to secure and monitor your request.

You can collect your card at a branch as soon as your account is activated.

Each online account opening makes you eligible to try to win a streaming subscription during the period from 02/01/2026 to 04/31/2026.

Winners will be contacted every month by our partner to choose their platform and activate their streaming subscription.

If your choice is no longer available, you can select another platform from those still in stock.

For more information, you can check the rules directly at the following link: Streaming Offer Rules.

A bank card is included in the offered packages. Once your account is activated, your branch will inform you as soon as your card is ready so that you can collect it with ease.

You will then be able to easily set up your PIN by phone and later modify it at an ATM.

No, account opening is free and there are no maintenance fees for the first six months. You also benefit from included online banking services, with no requirement for an initial cash deposit (the minimum deposit of 100 DH is not required at account opening).

Once your file has been approved, you will immediately receive your bank account details (RIB) and login credentials. This means that your account is active and ready for use. You can then access your online banking services and carry out your initial transactions without delay.

To open an online bank account with BANK OF AFRICA, you must meet the following simple requirements:

- Be a legal adult (over 18 years old), a resident of Morocco, and legally competent.

- Use the account solely for your personal needs: it is intended for individuals and cannot be opened for professional activity.

- Have a valid mobile phone number and email address, required for identity verification and receiving your online access credentials.

- Provide an official identification document (CIN or residence card) and, if necessary, proof of address if your current address differs from the one on your document.

Once your application is approved, your account is activated promptly, and you will receive your BMCE Direct credentials to manage your finances immediately.

Account opening is done entirely online, without any need to visit a branch, except for collecting the bank card. All steps—identity verification, electronic signature, and activation—are carried out remotely in a simple and secure manner.

- Initiate your application: Start your application by verifying your identity document.

- Verify and confirm via video: Securely confirm your identity live with an advisor.

- Sign your contracts safely: Complete your account opening through electronic signature.

- Receive your credentials and access your account: Receive your BMCE Direct username by email and password via SMS, and download the application from the stores.

For more details on the required documents or the complete process, please consult our dedicated account opening FAQ.

To get more informations about the offer, please, refer to this link : Streaming Raffle Rules

My account

My account

The Group

The Group